Erisa Definition of Investment Advice Is Best Described as

Code 1002 - Definitions. Something important to note is that regardless of whether you hire an advisor in a 321 or 338 capacity the advice and process should really be the same.

2022 Sustainable Impact Investing Outlook Reimagining The Future Glenmede

As provided in Section 401b1 of ERISA 29 USC.

. Investment advice is just what it sounds like. I advising others as to the value of securities or as to the advisability of investing in purchasing or selling securities or ii who issues or promulgates analyses or reports concerning securities2. Under the new rule fiduciary investment advisor status will occur if a person makes certain recommendations as described below for a fee and A represents or acknowledges that they are acting as a fiduciary within the meaning of ERISA or the Code B renders advice pursuant to a written or verbal agreement arrangement or understanding that.

Investment Advice Fiduciaries are investment advisers broker-dealers banks and insurance companies and their employees agents and representatives. The second piece is written for retirement investors. The regulation states that a person provides investment advice if he or she.

Existing Definition of Fiduciary Investment Advice. 2 on a regular basis. Recommendations as to the advisability of acquiring holding disposing or exchanging securities or other property including recommendations concerning investment of securities or property to be rolled over or otherwise distributed from a plan or ira.

1101b1 the Plan Asset Regulation reiterates that a plans investment in an investment company that is registered under the Investment Company Act of 1940 ie a mutual fund does not subject the assets of the registered investment company to ERISA. The terms employee welfare benefit plan and welfare plan mean any plan fund or program which was heretofore or is hereafter established or maintained by an employer or by an employee organization or by both to the extent that such plan fund or program was established or is maintained for. Represents or acknowledges that it is acting as an erisa-covered fiduciary with.

Solely in the interest of participants and beneficiaries. Closing the book on continuing the ERISA best interest debate - is there anything left to argue about. Its general partner managing member trustee adviser or similar entity becomes an ERISA fiduciary with respect to the assets attributable to investors that are subject to ERISA.

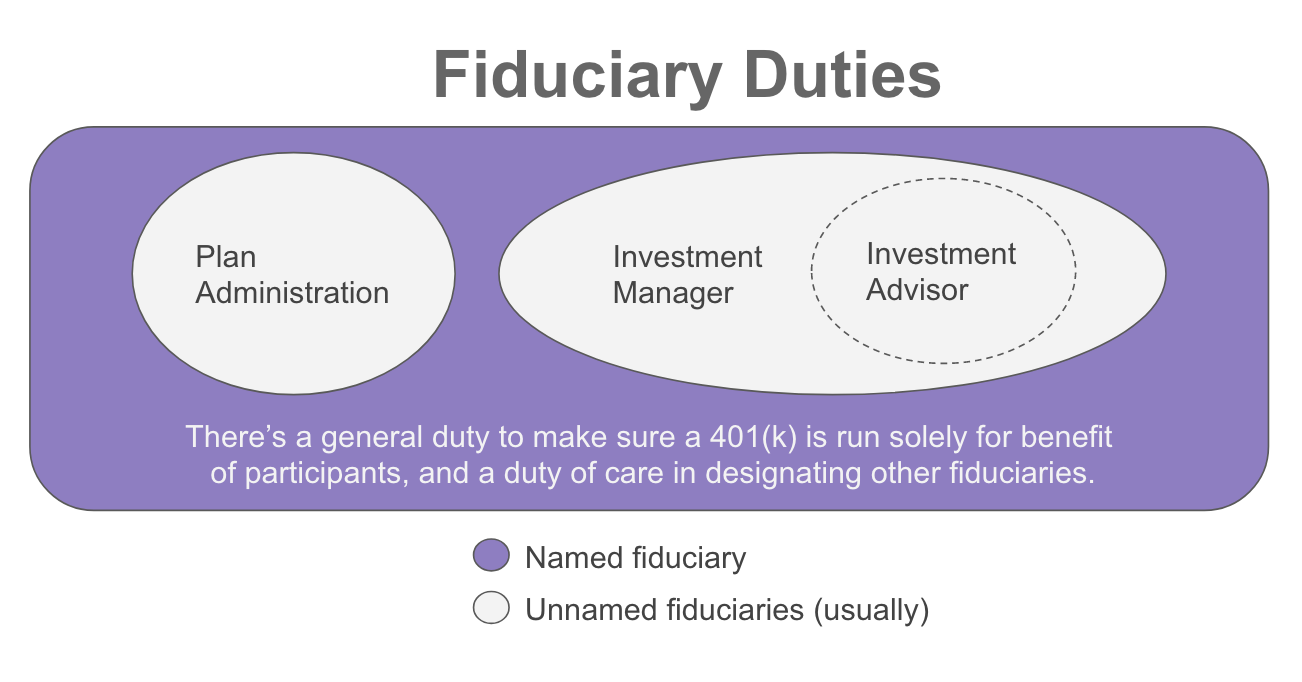

In 1975 the DOL issued a five-part test under ERISA Section 321 for determining under what circumstances a person or entity is treated as providing fiduciary investment advice to an ERISA-covered benefit plan. How does ERISA define fiduciary investment advice. Current Investment Advice Standard Under ERISA an individual who serves in a fiduciary capacity with respect to a covered plan is subject to heightened duties and responsibilities including among others to discharge its obligations to the plan.

The first piece contains a detailed set of FAQs for investment professionals and financial organizations. Experts say this new definition will cause many registered investment adviser RIA services that were previously considered non-fiduciary under the Employee Retirement Income Security Act ERISA to be subject to a fiduciary best interest standard of. The definition of an investment advice fiduciary in ERISA itself as adopted in 1974 uses the same terms as the proposal to define an investment advice fiduciarya person that renders investment advice for a fee or other compensation direct or indirect with respect to any moneys or other property of such plan.

1 renders advice to a plan as to the value of securities or other property or makes recommendations as to the advisability of investing in purchasing or selling securities or other property. In contrast an ERISA 338 Investment Manager has the authority to make investment decisions without the approval of other plan fiduciaries. A person is an investment adviser if he or she for compensation engages in the business of.

Here are the main takeaways from thi. Under ERISAs statutory text a firm or investment professional provides fiduciary investment advice to the extent she renders investment advice for a fee or other compensation direct or indirect with respect to any money or other property of such plan or has any authority or responsibility to do so. A person is an investment advice fiduciary if she makes a recommendation to a plan plan fiduciary participant or IRA owner about an investment rollover or distribution or about investment management eg portfolio composition and either 1 she acknowledges she is a fiduciary 2 the advice is pursuant to an understanding that it is based on the recipients.

Eversheds Sutherland US LLP To view this article you need a PDF viewer such as Adobe. A description of the administrative or investment services including investment management investment advice investment products plan administration and custodial or trustee services that will be offered including identification of and a description of the role of affiliates who will help provide those services. In Rule 30 DOL refined its interpretive position on when rollover advice is fiduciary investment advice for purposes of the Employee Retirement Income Security Act of 1974 as amended ERISA.

The DOL has issued two pieces of guidance on its new fiduciary advice prohibited transaction exemption. 3 pursuant to a mutual understanding. Covered investment advice is generally defined as a recommendation to a plan plan fiduciary plan participant and beneficiary and IRA owner for a fee or other compensation direct or indirect as to the advisability of buying holding selling or exchanging securities or other investment property including recommendations as to the investment of securities or other property after.

4 that such advice. It means to provide recommendations or guidance that attempts to inform guide or educate someone about a particular investment product or series of. A benefit plan investors investment in an entity will cause the assets of the entity to be treated as plan assets unless one or more of the following exceptions apply.

The Importance Of Retainer Fee Based Financial Planning Wealth Management

Working With 3 38 Investment Managers Pensionmark

![]()

The Only Thing A Person Can Ever Really Do Is Keep Moving Forward Take That Big Leap Forward Without Forgetting The Past Monday Motivation Keep Moving Forward

Who Is An Erisa Fiduciary Now And What Should One Be Doing Word On Benefits

Alert Pte 2020 02 For Investment Advice Fiduciaries Overview And Checklist Lexology

Lunch And Learn Invite Template Inspirational Lunch And Learn Invitation Best Event Flyer Invitation Template Simple Invitation Printable Invitation Templates

Erisa Fiduciary Duties Of A 401 K Plan Sponsor Guideline

Look Beyond The Label When Exploring Esg Investment Options

Pop Candy Cocoppa Play Wiki Fandom Powered By Wikia Candy Icon Pink Wallpaper Fantasy Doll

Why You Should Max Out Your Retirement Accounts Podcast 164 Maxing Out Your Retirement Accounts Will Make Estate P Retirement Accounts Accounting Retirement

10 Hidden Features Of Larkspur Rixtrema You Need To Know About Larkspur 10 Things Need To Know

Look Beyond The Label When Exploring Esg Investment Options

Alert Pte 2020 02 For Investment Advice Fiduciaries Overview And Checklist Lexology

Dol Reinstates Five Part Test For Determination Of Erisa Fiduciary Status Hall Benefits Law

Be A Winner Life Agent Investment Advisor Tuesday Motivation

Northern Trust Asset Management Developing An Nt Esg Vector Score Case Study Pri

Comments

Post a Comment